The finance sector continues to transform as it adapts to several, major forces, including altering regulations, consumers’ increased use of digital banking and demands for increased cybersecurity. Following the 2008 recession, large financial institutions changed where they focus their investment dollars, namely less in personal lending and more in wealth management and investment banking. Also, consumers’ expectations that transactions can happen anywhere, anytime, means institutions must attract and retain a variety of tech workers and compete with top tech companies for talent. Meanwhile, emerging financial technology, or fintech, companies continue to research and develop digital solutions to nearly every aspect of banking and finance, often partnering with larger firms and companies.

In finance offices, from trading floors to fintech startups, lean operations and efficient use of space take top priority as urban real estate prices rise and young workers demand urban locations. Many back-office spaces have transitioned from a collection of individual, static workspaces to something like leading tech firms, with open layouts, mobile furniture, few private offices and amenities like cafés, fitness centers and gaming areas.

Knoll interviewed professionals at leading finance firms, banks, real estate firms, architectural and design firms and building management companies associated with finance, to capture the most recent trends in the industry and what drives the finance workplaces of today. Speaking with these industry insiders, we identified characteristics and priorities of the finance workplace.

This report summarizes our research, covers key trends in the industry and provides workplace planning and design strategies for finance companies.

Drivers, Culture + Characteristics

The factors influencing the finance industry’s culture vary widely. “Tech-preneurs” hustle to create a must-have app for consumers while private wealth management firms work to maintain an air of tradition, trustworthiness and unchanging values. Add to these varied settings the fluctuation in government regulations and the pressure to remain profitable and you start to understand the diverse, dynamic culture and characteristics of the finance industry.

Slow Growing Momentum

Finance firms have recovered profitability, but slowly, since the 2008 recession. Though banking and finance industry employment grew in 2014 at its strongest rate since 2006, up 1.9% year-over-year, it still lagged behind the nationwide average of 2.4% in the same time period, according to data from the Bureau of Labor Statistics, and was 3.7% below its pre-recession peak.

But, there have been some positive signs towards accelerated growth more recently. Between 2010 and 2015, finance industry wages have grown 43.5% faster than the average growth in other non-farm industries, as reported by the Bureau of Labor Statistics. Salaries for compliance officers, in particular, have grown quickly, ahead of compliance officers in other industries.

Plus, financial corporate profits are hovering near record highs, after suffering negative returns in 2009, according to the Bureau of Economic Analysis. “The industry has recovered substantially from the great recession,” says Bruce Wolferding, Vice President of Business Development for NewGround, an architecture and design firm based in St. Louis that specializes in finance industry clients. “Income has recovered which has allowed banks to build their equity and capital position. There are still some lagging issues, such as the margins banks make on deposits due to historically low interest rates. But, the squeeze has simply forced greater efficiencies,” Wolferding says.

Wolferding sees a pent-up demand for expansion and renovation. He says plans that had been put on hold in recent years are now moving forward.

Belt Tightening All Around

Firms are working hard to reduce expenses and increase revenue wherever possible. Real estate costs and employee salaries remain top expenses, while low interest rates reduce what lenders can charge on loans and earn on investments.

The reduced headcount at branch locations and in mortgage lending frees up resources to adapt to new consumer needs and hire more tech-savvy talent in roles like data analytics, network maintenance, web development and cybersecurity. Also, more funds can go towards legal work to handle compliance to regulations.

Overall, firms’ real estate footprint is shrinking, particularly branch volumes and sizes. JP Morgan Chase looked to lower its efficiency ratio between 2015 and 2017 by closing 300 branches and reducing headcount in divisions like retail banking and investment banking.

Michael Davidson, Managing Director of Real Estate for the Americas for JPMorgan Chase, says that it’s a typical challenge of figuring out which types of employees and how many are needed in the most high cost areas, and which support roles can be moved to lower cost areas. Plus, a large bank like Chase has a very complicated real estate portfolio. “After many years of mergers and acquisitions, companies accumulate quite a bit of real estate and the question is, ‘What is the real estate we’ve inherited by virtue of M&A [mergers and acquisitions] and, based on that, what are the best places to keep and the best places to exit?’” says Davidson.

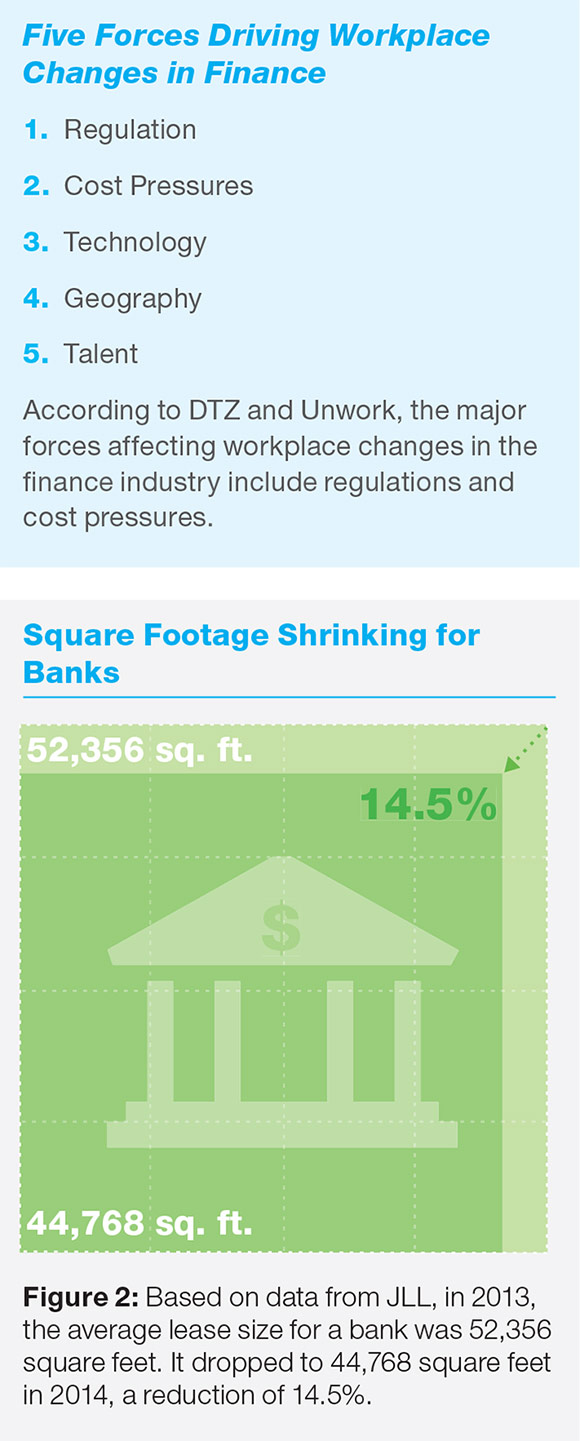

As part of shrinking real estate needs, for the first time in years, according to JLL, relocations surpassed renewals in the industry (46% versus 24.8%), and the average lease size shrunk nearly 15% in 2014. Consolidating offices allows for greater density with more efficient, open work environments, a first for the industry.

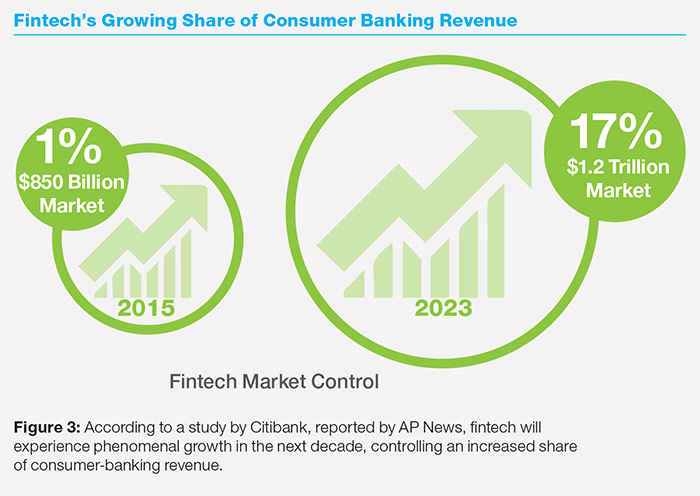

Fintech Growing Quickly

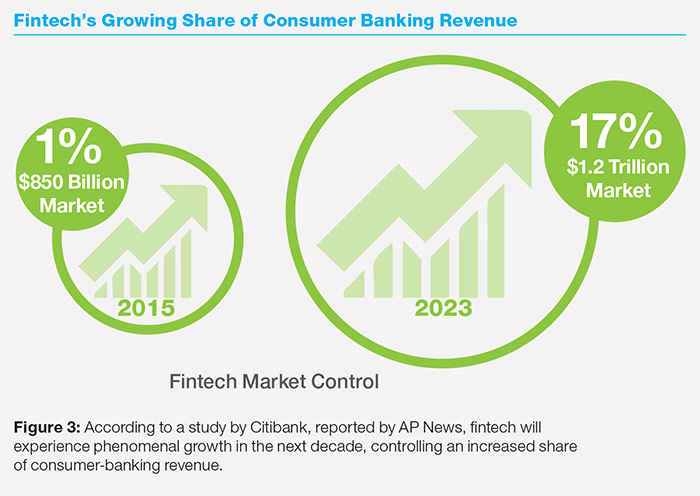

A fairly new sector of the finance industry, financial technology or fintech, started showing the documentation of investment dollars and activity in 2015 to make it a mainstream player. Fintech companies produce technology designed to handle a number of financial services transactions, from lending to investment advising. In 2015, as reported by KPMG and CB Insights, venture capital firms invested more than $13.8 billion globally in fintech, more than double the value of VC investment in 2014.

“I am a believer that the bank of the future will be a collection of apps on your phone,” says Savneet Singh, founder and president of GBI, an online exchange for gold and silver, who has invested in about 10 fintech startups so far, including ones specializing in lending and insurance.

The areas of finance fintech companies have focused on most include digital and mobile mortgage transactions, student loans, financial advising and moving funds between countries.

Many global firms supporting fintech lab space hope to tap into mobile, cloud, analytic, cyber security and regulatory innovations. The number of fintech companies globally has grown 26% year over year. Some industry studies show that moving daily financial transactions to mobile cuts the cost of customer interactions by more than half.

Large technology firms, like Apple with Apple Pay, are also entering the market. Companies like Google and Facebook are expected to become more involved as partners who can lead consumers into digital transactions from their sites. For example, according to research from Goldman Sachs, by early 2015, onetenth of all payments in China were made by Alipay, a third-party online payment platform founded by tech giant Alibaba Group.

Dramatic change is expected, as many technologists suggest that the future of money may include no money. More cashless transactions via devices, facial recognition, wearable technology and bioimplants could come soon so investments in data storage, analytics, cybersecurity and other technology disciplines is expected to grow. One UK study showed that contactless payments in the first six months of 2016 outpaced all of 2015.

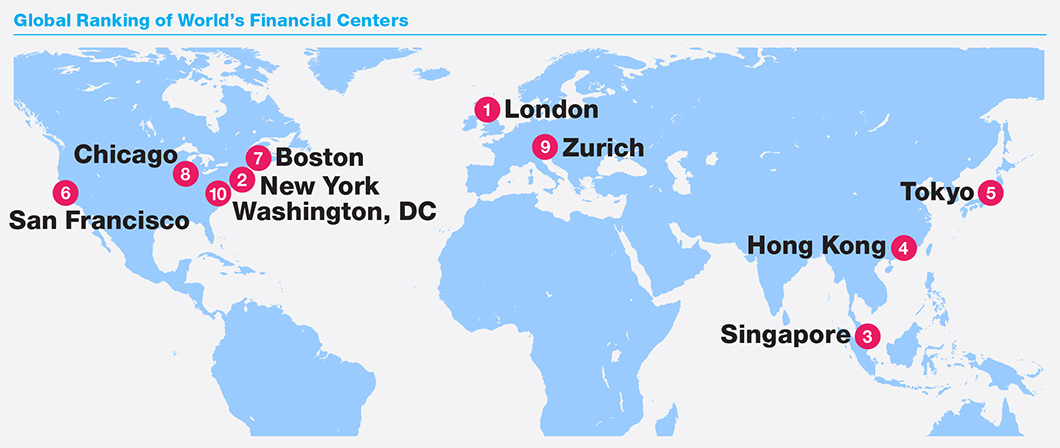

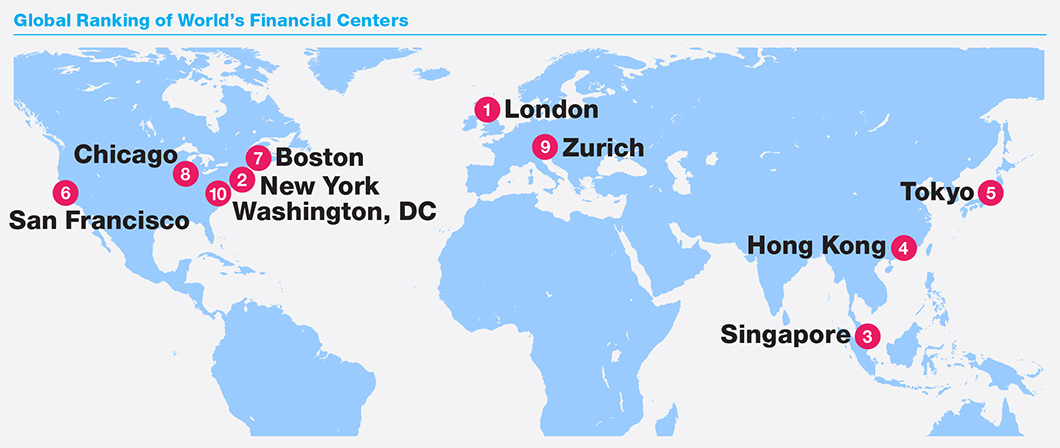

In the United States, the top areas for fintech research are in Silicon Valley and New York City. While early startup offices may be small, the need for expansion can come fast—making the segment one to watch for investors. According to research from JLL, fintech will have the biggest impact on absorption levels in Silicon Valley and New York City. And, over time, its impact will drive leasing and activity in Boston, Atlanta and Denver as it seeks access to a millennial workforce.

Omni-Channel Presence Is Required by Consumers

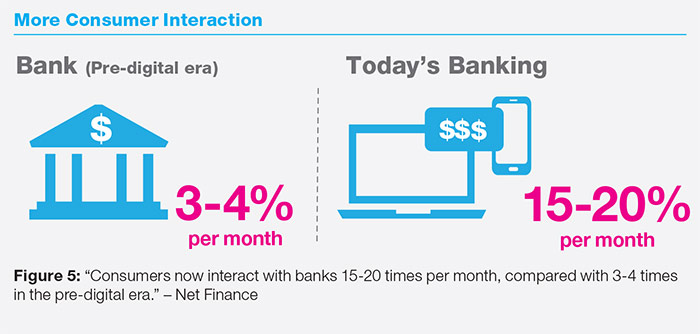

A customer-centric, omni-channel strategy is essential for today’s most successful financial firms. While self-service options, like ATMs and online banking, continue to grow in popularity, a 2014 survey by the FDIC found that 78% of respondents used a bank teller over the previous year. Plus, consumers still go to branches for major life events, like borrowing and wealth management decisions. Large organizations must meet all of these needs, and efficiently, in order to compete.

In response to changing needs at branches, many institutions are shrinking branch footprints and spreading them around through more geographies. They’re also training a new kind of staffer who can serve as a knowledgeable advisor in a range of highvalue transactions.

Finally, as more consumers go digital with their finances, customer service call centers have grown in size and importance, as well as the sophistication of the employees responding to requests. Often called remote virtual specialists (RVS), these highly-trained employees work in call centers, usually located in suburban areas with less-expensive real estate. The goal is to provide consumers support in keeping their everyday transactions where they cost less, online.

Workplace Priorities

In an era of increased demand for digital banking options from consumers, space efficiency and investing in technology take top priority with most finance companies right now. More traditional financial work, such as investment banking or trading, continue to require significantly more square footage per employee and private work spaces for staff.

1. Make room for larger back-office staff

Overall, hiring in the finance sector has been below national averages, at 1.9% compared to nationwide 2.4% since February 2015. Financial institutions are seeing less profits for work done by front office staff, such as research analysts, investment bankers, and traders. They’re putting more money into hiring back office staff that support cybersecurity, legal and compliance work.

Finance organizations’ hiring needs are diverse, even within technology. “We have a large technology organization in the company. We have technologists running our digital platforms and web pages that clients use; others work on the internal infrastructure for the bank while another group is the service organization for the lines of business such as the traders and bankers,” says Michael Davidson, a managing director of real estate for the Americas for JP Morgan Chase.

Financial institutions are competing directly with technology companies by choosing non-traditional office locations in urban centers where Millennials, in particular, like to live and work. While traders and investors may stay in traditional Central Business Districts (CBDs), according to research from Unwork and DTZ, banks are moving certain workers to mixed used, vibrant Connected Urban Environments (CUEs).

“We’re on one end a traditional bank and the other end kind of like Google,” says Anthony Riccio of financial services firm Blackstone. Many large organizations, like Bank of America, are also investing in innovation centers or “labs” in places like the Silicon Valley, New York City and Boston, where the highest concentration of tech talent lives. “We’re seeing a ton of money being poured into labs. It’s just become so white hot,” says Brad Ritner, Director of Retail Design at Newground.

2. Design for a young, tech-savvy workforce

“IT is taking the lead on how are we going to change our design going forward because they hire the most Millennials,” says Riccio of Blackstone. He shares the example that traditionally cautious and restrictive IT departments at financial institutions are allowing for more bring-your-own-device (BYOD) options for employees. Riccio says this shift impacts design.

Many design firms are taking cues directly from the tech sector. “We understand that good ideas may surface in sectors outside finance. I think everyone is recognizing that, in order to secure and retain quality employees, they’re having to explore things they didn’t necessarily have to 20 years ago,” says Wolferding of NewGround.

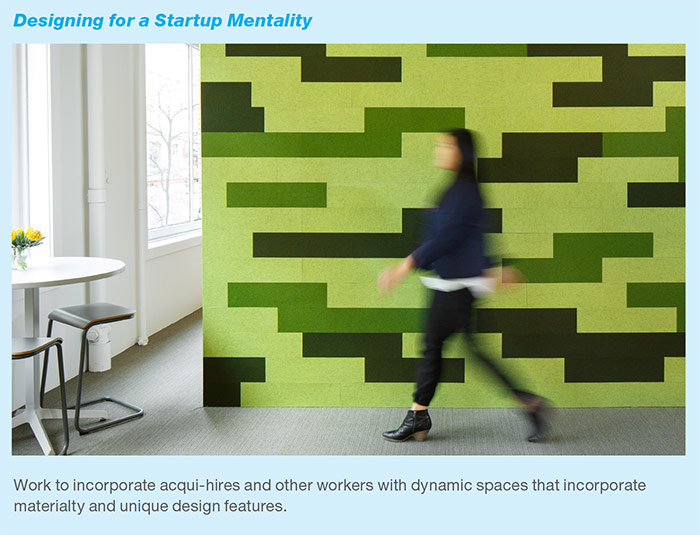

For example, as part of their effort to gather intellectual firepower, many large financial institutions acquire small companies. They must accommodate these new, startupminded workers or lose them. This mixing of cultures creates unusual design challenges. “They really work hard to incorporate and integrate the cultures of these small tech companies into their larger groups,” says Currie Gardner, Senior Designer at HLW in New York City.

The fact that many younger workers came of age during the financial crises complicates recruitment and retention for banks even more. Fortunately, opportunities to make big, intellectual contributions and overcome challenges by digitizing financial transactions has proven an effective recruiting tool for the finance industry.

3. Improve efficiency of in-person transactions

Tellers still serve many customer’s needs, despite increasing use of online banking options. Considering this continued dependence on personal attention, financial institutions are trying to create a great inperson experience as efficiently as possible. “We’re seeing a hub and spoke model at the branch level. Where perhaps 10 years ago banks and credit unions would have built 7,000 or 8,000 square foot sites. Now, a bank or credit union may have a flagship strategically placed within in a community where it offers a full range of services, then micro-branches in busy areas like strip centers, with adjacent parking,” says Ritner of Newground.

Finance organizations are using the high numbers of micro-branches to increase the geographies they cover, more so than in the past. More customers can reach their bank, ideally, and complete their transactions without needing much space or time with tellers. This increasing number of locations keeps current customers happy, while also making it easier to attract new customers passing by.

Beside micro-branches for in-person transactions, financial institutions are experimenting with more typical-sized branches in wealthy neighborhoods or near high-end shopping centers, such as Denver’s Cherry Creek. They hope to interact with affluent customers who need services like wealth management. These locations might feel more like a café, with coffee, wifi and comfortable furniture. They often also include huddle rooms or private offices for staff to meet with customers or a senior-level corporate staffer to work for a day.

4. Minimize real estate costs

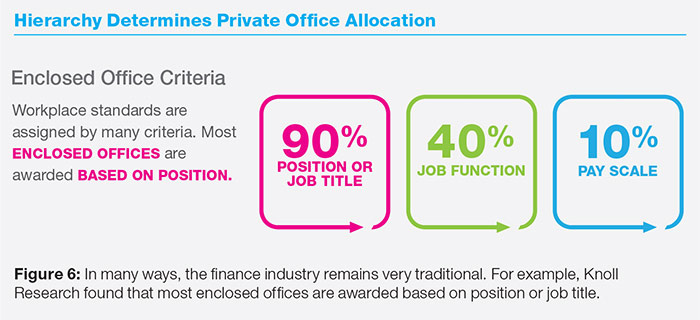

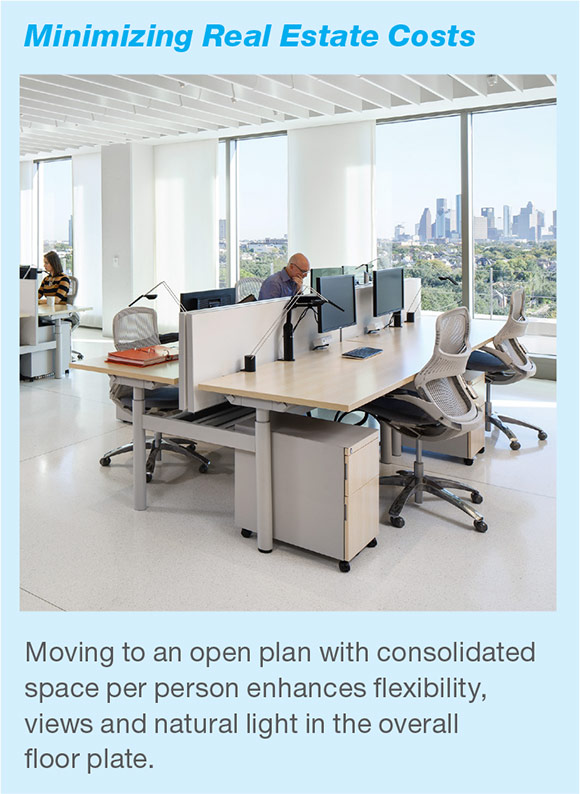

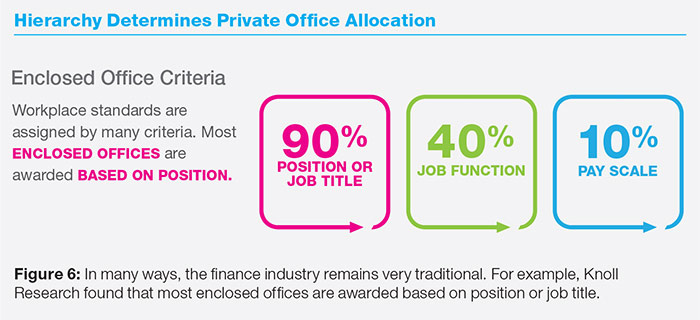

The increased cost of real estate in the world’s financial centers has led to the average space per worker in finance shrinking by 25% from 16.6 sq m (178 sq ft) to 12 sq m (129 sq ft) globally over the last ten years, according to Unwork and DTZ. Though federal regulations on financial institutions can be difficult to interpret and institutions must move cautiously to avoid fines, there is an overall movement towards cost savings through open office plans and fewer private offices where possible.

By developing strict security measures for employees regarding data transfer and information storage, organzations are able to create more collaborative spaces, allow corporate employees to work from home and, thereby, reduce the footprint per employee in their corporate spaces.

Michael Davidson of JP Morgan Chase sees the shift to open floor plans as a result of technology’s impact rather than an effort to cut costs, saying, “The shift to more open floor plans is more about technology and changing culture, how people are managed, led and work together, and the ability to create different environments using technology that enhance the flexibility.”

Other designers agree. “People don’t need as much space for storage anymore. We are not seeing 8x10 workstations. They’re more like 6x7 or 7x7. Most of the information comes digitized anyway.” “Everything is online or on the server,” says one real estate expert. Many industry insiders note that organizations are also consolidating their corporate offices into single, geographic locations rather than having multiple headquarters, as a way to increase efficiency and reduce their real estate portfolios.

In an effort to optimize the selection of retail locations, financial institutions are now using more data on client demographics. “There’s a lot more thought that goes into the actual location rather than just grabbing corners, like it used to be,” says David Ditchman, Executive Vice President for E. Smith Real Estate of Dallas, TX. Banks and credit unions do more site-selection analyses than before to understand where their clients currently work and live, as well as where they’re moving in five or 10 years.

Workplace Solutions and Strategies

To help financial institutions create workspaces that balance diverse business needs, while offering more collaborative areas for employees, we suggest the following solutions and strategies.

1. Improve efficiency in back-office workspaces

To cope with the impact of rising, urban realestate costs, designers are working hardto use in-city, office square footage moreefficiently. One approach is getting back-officeemployees out of private offices wheneverpossible. Even shared spaces are beingminimized. Anthony Riccio of Blackstonenotes, for example, that people’s workstationsin an open floor plan may not be big enoughto host a meeting with a colleague but heand his team make it possible for a meetingto happen in an employee’s “neighborhood,”about every third or fourth workstation.

Meanwhile, traditional roles, such as analysts,portfolio managers and traders, continue tooccupy significant square footage, since manyrequire desks with telephones or comfortablemeeting rooms for clients. Overall, thetraditional spaces found in business districtoffice towers demand more square footageper individual employee than support roleslike web design and cybersecurity.

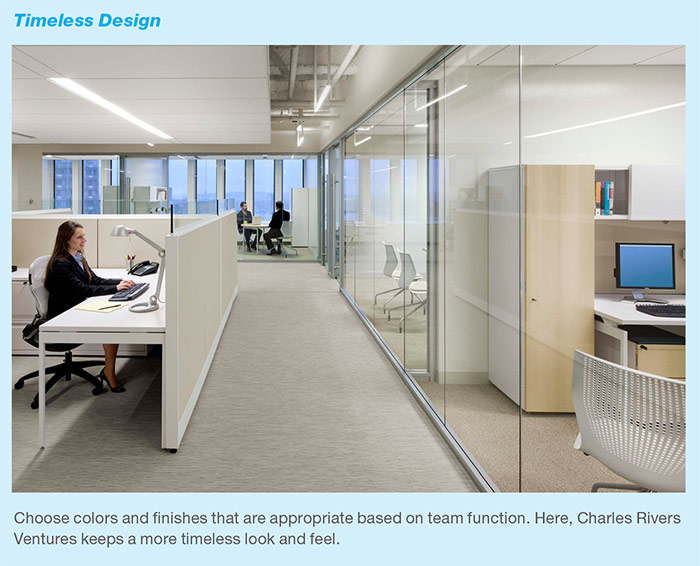

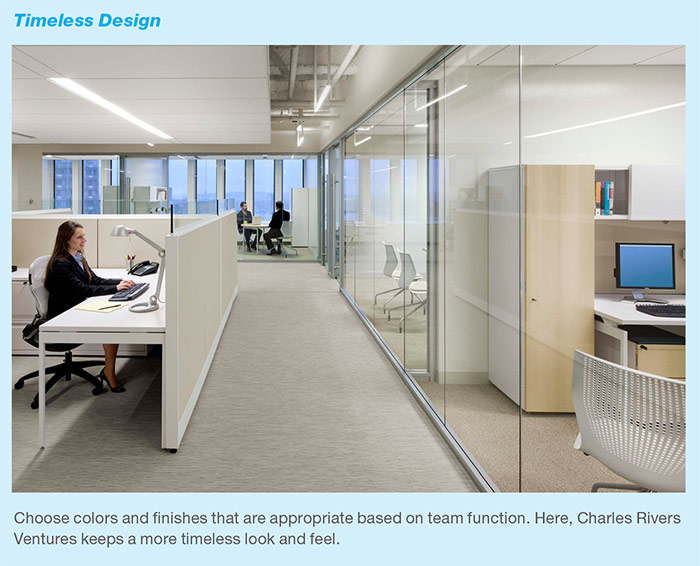

Even the aesthetics of these two spaces highlight the contrasting cultures that designers in the finance industry face. Tech department spaces tend to embrace bolder colors and a more minimalist style, such as exposed beams and clean lines, according to Gardner of HLW. Meanwhile, Michael Davidson says Chase has chosen, overall, to hold onto the more traditional look expected in the finance industry, saying, “We’re looking at colors and finishes that are more timeless, less flashy and more durable.”

Planning Strategies

- Maximize space efficiency in prime, urban real estate, particularly in backoffice staff locations.

- Choose materials and finishes that fit departmental cultures and level of client interaction.

- Invest in high-quality materials and fabrics to keep employees motivated and comfortable.

- Consider keeping the look for tech spaces unfinished to encourage a sense of scrappiness and new thinking.

2. Create a mobile, in-office work experience

Another trend in finance industry offices is allowing employees to work away from their desk, or not have an assigned desk at all.

At Edward Jones, Elizabeth Cockrell and her team are experimenting with reducing desk assignments to less than one desk per person. As part of this effort, “mobile employees” are offered a choice of a 2x2 locker or box-box file where they can keep their personal items. The box-box file is mobile and can partially nest over seated workstations.

In even more evolving environments, some finance employees never have an assigned desk because they work in a group at all times. For example, many tech workers are placed on a team to tackle a particular challenge. This team may only exist for three or four weeks then it will be broken up and employees will be placed on a new project with a new team. Therefore, the furniture used in tech groups must be highly reconfigurable.

“Sometimes they only have a half hour to reconfigure. So, it’s very dynamic,” says HLW’s Gardner. He and his team set a goal that whatever can be placed on wheels, from whiteboards to desks to video conferencing units, gets designed to move.

There are limits to the mobile office experience in the finance industry. For example, trading floors have not changed much in the past few decades, according to Gardner. “Trading floors are big. They’re a function. It’s like a kitchen, it needs to work,” says Gardner. He says the technology has gotten lighter but it’s still the heaviest among banking divisions since traders need multiple monitors and they stay at their workstation to be near their phone.

Planning Strategies

- Use mobile and flexible furniture solutions that can adapt and be moved easily. Ideally, solutions are reconfigurable by end users because they are physically lightweight and/or on casters.

- Offer seats and tables at varying heights for employees working away from their desks.

- Include comfortable team and community gathering spaces near established workstations.

- Leverage software that enables employees to give status updates on their location to facilitate interaction.

3. Mix in spaces for collaboration

In general, walls are coming down and companies are experimenting with different combinations of chairs, tables, writing surfaces and A/V equipment in collaborative areas.

“They want to increase the collaboration and remove the panels and anything that separates people,” says one industry professional. Riccio at Blackstone has even studied the optimal number of seats in a collaborative space. “We found that groups of three to four don’t work. Groups of six do,” says Riccio. He and his team make sure there are always at least six chairs or stools in an area that can be pulled together for a meeting.

Another aspect of collaboration is writable surfaces. Ricco has tried everything from glass to whiteboard walls. “If you have a whiteboard or writable paint, then everywhere you go is a potential, impromptu meeting,” he says.

Riccio adds that collaboration areas away from desks are only one strategy. Another one is making workstations possible minicollaboration spaces. “We’re designing not only for collaboration areas, but for collaboration within your area. Bring in secondary seating with a barstool, a pad on top of a box-top file or raise the desk and three people can stand around it because nobody needs to sit,” says Riccio.

Private offices still dominate the most traditional areas of banking, but they are changing. One company only allows managing directors on its trading floors to have private offices. The rest of the team has semi-private workspaces but no private rooms.

“The newer technologies don’t relate to the investment bank portion of the business because if you work for them you’re in a specific group, in a specific desk and you’re doing a specific task,” says Riccio.

Planning Strategies

- Offer multiple-height desks, tables, chairs and stools so employees can feel supported and comfortable in shared spaces.

- Create designated zones through the use of color or pattern differentiation within the workspace to support transitions between individual work, informal interactions and group work.

- Have writable surfaces, such as mobile and wall-mounted whiteboards, glass walls or boards, and writable paint available wherever possible.

- Track space utilization to plan most efficiently.

- Ensure collaborative areas, both enclosed and open meeting spaces, are equipped with the appropriate technology to enable video conferencing with employees in other locations.

- Firms with global operations can offer unassigned seating, or hoteling space, for mobile or travelling employees so that one desk serves multiple people.

4. Design for in-person, client comfort and luxury

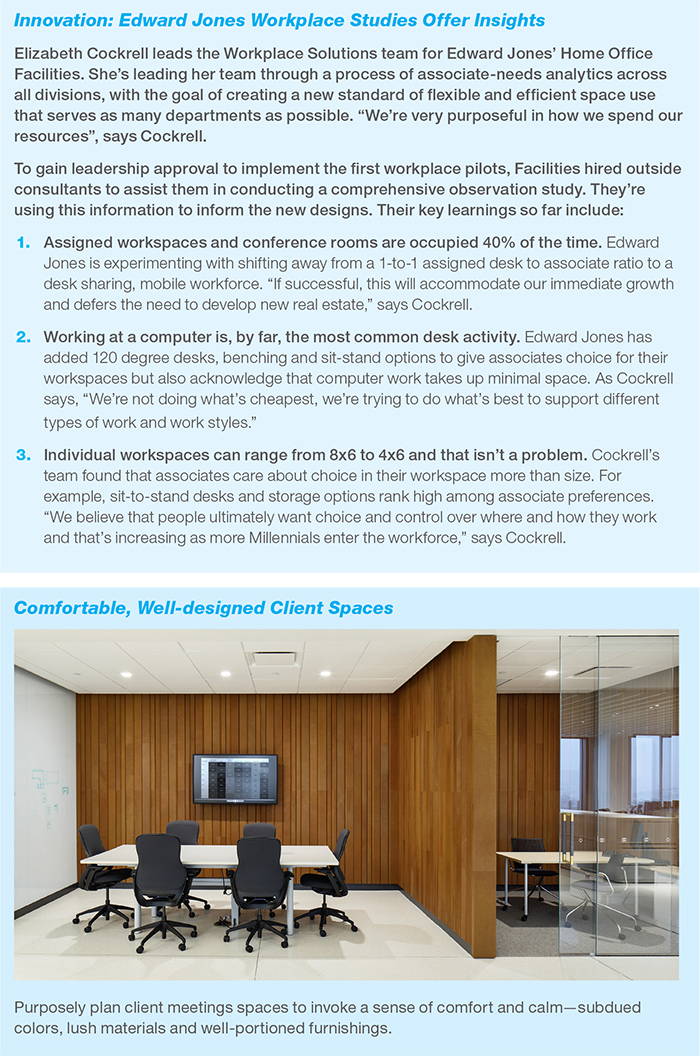

As streamlining and budget-conscious choices take center stage, many financial institutions involved in wealth management and investing still need to offer tailored, beautiful spaces for client meetings.

“Their need for meetings with clients and maintaining an image still exists,” says E. Smith’s David Ditchman.

“If you’re dealing with billionaires you have to make spaces that make billionaires feel comfortable,” says HLW’s Gardner. He says that client meeting areas are designed to be beautiful, well proportioned, well scaled, located in affluent areas and, ideally, offer beautiful views. “You might have a dining room and a wine cellar in private banking spaces. Those still exist but I wouldn’t say they’re growing. They’ll always exist,” says Gardner.

He notes that the colors are often muted, inspiring a sense of calm and safety. Rich materials such as leather and marble are common, creating a classic look, but nothing that seems too extravagant so clients know that the institution has their best interests in mind.

Unlike the tech offices where flexibility rules, the investment banking part of any institution still relies on a more static design. “The investment bank likes it more fixed. I need one room and give me everything in this room,” says Riccio.

Planning Strategies

- Choose a location in a central, affluent area of town.

- Use high-quality materials and finishes that connote a classic look, such as leather and marble.

- Select neutral, muted palettes that promote relaxation and trust.

- Offer spaces and amenities such as a formal living room with great views.

5. Offer competitive workplace amenities

Finance firms are investing more in employee comfort to boost retention.

“When real estate folks are going out and looking for space for finance firms, they’re coming at it from a very different perspective than I’ve seen in the past. A lot more of the focus is around their employees. One person who is sitting in the meeting from the very beginning that we haven’t seen in the past is the head of HR. From a strategic planning level, it’s about attracting good talent and taking care of people,” says Ditchman.

For example, ergonomics came up many times as an essential perk in back-office work spaces. Adjustable furniture and task lighting versus overhead light, are ways firms help employees feel more comfortable at work.

“Food is an amenity, such as the cafeterias and food services we provide,” says Davidson of JP Morgan Chase. These in-office, micro-cafés offer free beverages, food at a discounted rate, TVs for entertainment and a space to relax with colleagues.

Gardner of HLW adds that wellness rooms, where employees can nap, rest and recharge have become common in some departments. They’ll also often offer a massage area, a yoga studio and outdoor spaces or at least gathering spaces with access to natural light.

In more traditional financial office towers, a big, energy-filled lobby is essential. “You want to walk into a Starbucks or other popular cafe with coffee and food. You want the employees to come down there and meet and work, create some energy,” says Gardner.

Planning Strategies

- Design for access to natural light and, if possible, create outdoor gathering spaces.

- Offer a centralized café and pantry with mix of tables and chairs, equipped with power, data and displays to function as a destination space and informal meeting area. Clinder offering free or discounted food and beverages.

- Divide floors into “neighborhoods” and offer different amenities to encourage circulation and serendipitous interactions.

- Encourage movement and activity through open staircases and centralized printing, copy and storage areas.

- Include games, such as ping pong or foosball, that provide physical activity and fun interaction with colleagues and ensure policies encourage employees to use spaces.

- Offer nap areas, massage, yoga, meditation or other soothing activities to help employees manage stress and relax.

Future Outlook

Federal regulations on financial institutions will continue to shift but organizations have learned to adjust to fluctuations by focusing on existing profit centers. Efforts to stay lean and profitable will continue. Jobs that do not have to be in-house may increasingly be sent off-site to save not only labor but real estate costs.

Future influencers include large tech companies like Apple, Google and Amazon that have access to huge volumes of data about consumers and their habits, as well as access to the consumers themselves via online portals. Even mergers between the two industries are possible. “In the tech world you have groups that have a tremendous amount of talent in data analytics that could be married with traditional banking structures, not just offering them support but actual M&A between the two because it is one way of getting the talent and data analytics banks and traditional investment banking firms don’t have,” says Andrew Davidson, Executive VP/Managing Director Corporate Services for MB Real Estate in Chicago, IL.

Cashless transactions will be more common. And, the speed of banking will increase. For example, improved data processing will make online lending quicker, creating stiff competition for banks that traditionally took days to approve loans.

Large organizations will continue to consolidate and buy up smaller companies to take advantage of efficiencies of scale. “You’re going to see increasing consolidation among the traditional players,” says Jill Schumaier of Newground.

Finally, the demand for great technology will only increase as Millennials and generations beyond them prefer banking on their phone rather than in-person. Despite all the change that has already occurred, designers predict more to come. “When we design these headquarters, we’re not looking for now. We’re looking for 5, 10, 15 years down the road. Technology is changing so quickly. Every two or three years it’s a whole different story. We’re designing for that,” says Schumaier.

Glossary

FINTECH Financial technology, the market of financial services firms whose product or service is built upon technology.

EFFICIENCY RATIO Measures how well a company uses its resources to make a profit. Used internally to determine if goals have been met and compare to company health to competitors in the market. Used by investors to determine stock value. There are many types, including debt to equity and price earning.

SEC The Securities and Exchange Commission is an agency of the United States federal government. It holds primary responsibility for enforcing the federal securities laws, proposing securities rules and regulating the securities industry.

Special Thanks

A special thanks to the following individuals and contributors who wished to remain anonymous.

Elizabeth Cockrell

Manager, Workplace Solutions Home Office

Facilities

Edward Jones

St. Louis, MO

Cathy French

Director

Global Workplace Strategy & Standards

Corporate Real Estate

Royal Bank of Canada, Toronto, ON

Andrew Davidson

Executive VP/Managing Director Corporate

Services

MB Real Estate

Chicago, IL

Michael Davidson

Head of Americas East Real Estate

Managing Director

JP Morgan

New York City, NY

David Ditchman

Executive Vice President

E. Smith Real Estate

Dallas, TX

Currie Gardner

Senior Designer

HLW

New York, NY

Lisa Korrect

Marketing Director

Newground

St. Louis, MO

Brad Ritner

Director Retail Design

Newground

St. Louis, MO

Anthony Riccio

Vice President

Blackstone

New York, NY

Jill Schumaier

Director of Interior Design

Newground

St. Louis, MO

Bruce Wolferding

VP of Business Development

Newground

St. Louis, MO

Miranda Wong

Director CIBC@work

Corporate Real Estate

CIBC

Toronto, ON

Anonymous Contributors

Project Manager in San Francisco

Process Lead in New York

References & Additional Reading

Investopedia, “Efficiency Ratio”

http://www.investopedia.com/terms/e/efficiencyratio.asp

JLL, “Banking and Finance Outlook 2015”

http://www.us.jll.com/united-states/en-us/Documents/Banking/JLL-banking-financeoutlook-2015.pdf

Unwork and DTZ, “The Future of the Financial Workplace”

http://www.unwork.com/wp/wpcontent/uploads/Unwork_the_future_of_the_financial_workplace_web.pdf

KPMG & CB Insights, “The Pulse of FinTech, 2015 in Review”

https://www.cbinsights.com/research-pulse-of-fintech-2015

JLL, “The Banking Industry: On the Move in 2015”

http://www.slideshare.net/JLL/2015-banking-industry-trends-and-outlook

CBS News, “FinTech: Shaking Up the Financial Industry”

http://www.cbsnews.com/news/fintech-shaking-up-the-financialindustry/

Knoll, “A Snapshot: Financial Institutions”

https://www.knoll.com/knollnewsdetail/asnapshot-financial-institutions

St. Louis Business Journal, “Online Lending Startups Gain More Favor from Investors”

http://www.bizjournals.com/stlouis/blog/biznext/2016/08/online-lending-startupsgain-more-favor-from.html

MX Enabled, “2015 Banking Trends”

http://www.slideshare.net/MXenabled/2015-banking-trendsslideshare

Contactless Cards Popularity Grows

http://www.bbc.com/news/business-37153565

ING, “Digital Revolution in Banking”

http://www.slideshare.net/ING/ing-digitalrevolution-in-banking-13-may2015

Z/Yen Group & China Development Institute, “Global Financial Centres Index 20”

http://www.longfinance.net/images/gfci/20/GFCI20_26Sep2016.pdf

SelectUSA, “Financial Services Spotlight”

https://www.selectusa.gov/financial-servicesindustry-united-states

H2 Ventures & KPMG, “2016 Fintech 100”

https://h2.vc/reports/fintechinnovators/2016

AP News, “Banking on Change: Tech Startups Target Financial Services”

http://bigstory.ap.org/article/ebc7bd3b13f142088cc07ef79dcfba8d/banking-change-tech-startups-targetfinancial-services

Global Financial Centres Index, “GFCI 20 The Overall Rankings”

http://www.longfinance.net/global-financial-centres-index-20/1034-gfci-20-the-overall-rankings.html